New money saving news from the Veterans Administration Loan Program about 2023 Funding Fees. This is for all VA home loans closing on or after April 7, 2023!

The VA funding fee for regular military members and reserve members is the same (verify eligibility with your loan officer). The VA Funding Fee is based on several factors, including the type of loan, the borrower’s military service status, the amount of the down payment, and whether the borrower has used the VA loan benefit before.

As of April 7, 2023, the Department of Veterans Affairs (VA) will be implementing a new funding fee rate for VA loans. This exciting change is designed to benefit veterans who are looking to purchase or refinance a home. In this blog post, we will discuss the details of this change and how it can save you money.

What is the VA Funding Fee?

The VA funding fee is a charge that is applied to VA loans to help reduce the cost of administering the VA home loan benefit. This fee is charged to borrowers who do not qualify for a fee waiver and is also applied to those who are purchasing or constructing a home with a down payment of less than 25%. The VA Funding Fee can be wrapped into the loan. Talk to your lender about what you qualify for.

What are the Changes to the VA Funding Fee?

Starting on April 7, 2023, the VA will be implementing new funding fee rates for loans that close on or after that date. The new funding fee rates will be applied to non-exempt veterans, and they will save borrowers money. The funding fee rates will remain the same for loans that close before April 7, 2023.

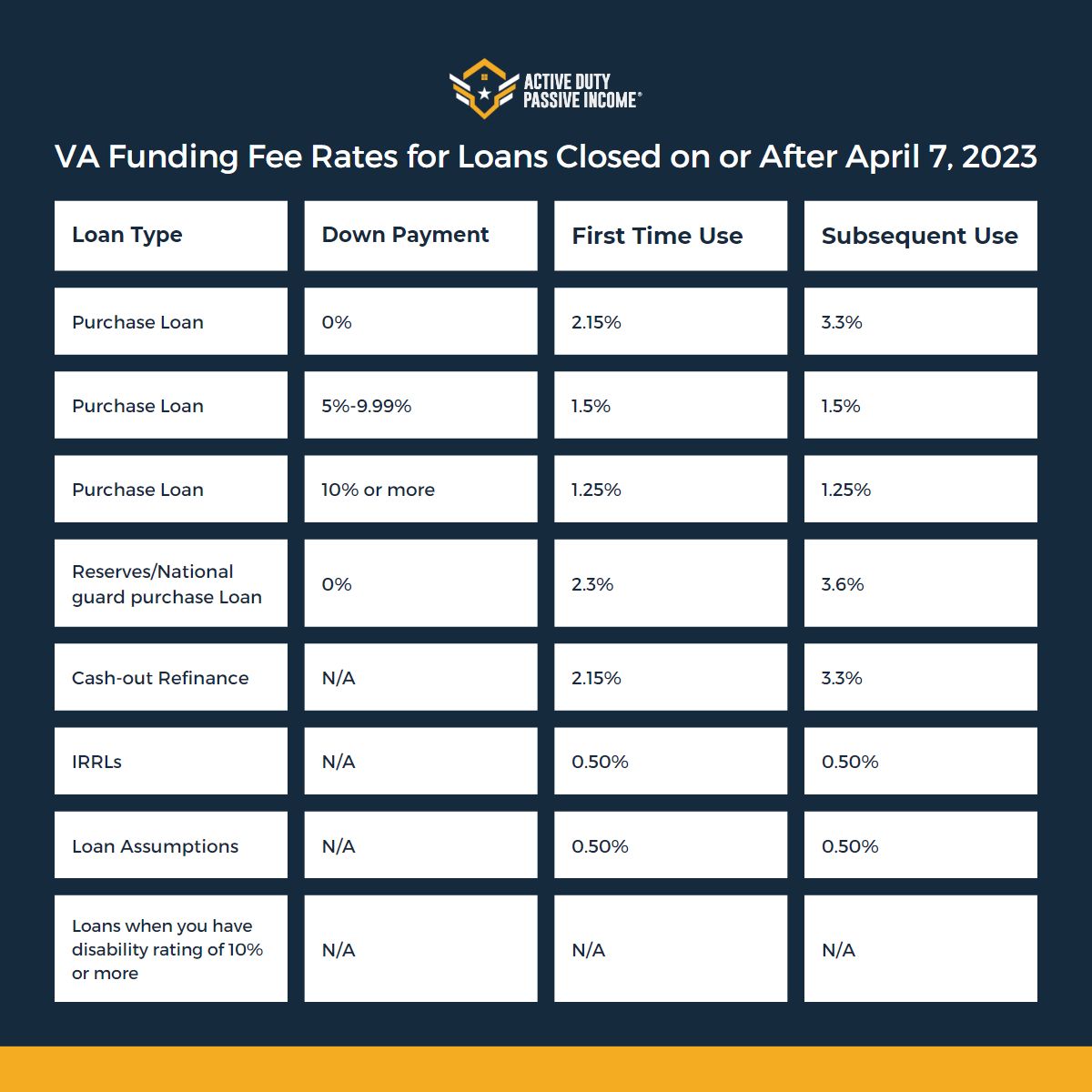

The new funding fee rates will be available on the loan fee table, which is located in the table below. The reduced funding fee for borrowers purchasing or constructing a home with a 5- or 10-percent down payment will still apply, and those too have been adjusted.

How Will the Fee be Calculated for Transactions with a Down Payment?

The VA calculates the funding fee based on the percentage down payment of the total purchase price or construction cost of the dwelling. For example, if a borrower makes a down payment of $18,000 on a home with a purchase price of $300,000, the percentage down payment is 6%. The Funding Fee Payment System (FFPS) will automatically calculate the required funding fee of $4,230 (1.5% for first time borrowers). Just a reminder the fee is calculated based on the amount you are borrowing not the original offer amount! Make sure you do the math twice.

New VA Funding Fee Rates Timelines

The new VA funding fee rates will be implemented for homes closed on or after April 7, 2023, and will benefit non-exempt veterans who are looking to purchase or refinance a home. This change will help borrowers save money in an environment where interest rates are higher than they have been in past years. Be sure to check with your lender for more information about these changes and how they can help you save money.

Table: VA Funding Fee Rates for Loans Closed on or After April 7, 2023