You heard it here folks, term insurance is not cheaper than a policy I create with whole life insurance. I repeat, “than a policy I create with whole life insurance.” I can’t speak for the myriads of other agents who draft a poor product- and for our purposes most of them do. Marylou from Big State Farmers Insurance Company will create an entirely different product under the name “Whole Life Insurance.”

That’s why we call our custom product the Cashflow Accelerator.

I hate saying that as it sounds a bit cocky, but most policies are, in my opinion, created horribly disadvantageous for the client and I don’t know how else to spread this message than to be totally up front. This topic is more of my passion project than anything else.

I’ve been a real estate investor for many years and I was using whole life insurance policies for cash value purposes. My goal was to create my own economy and self-banking ecosystem. I did this for years before becoming a life insurance agent with ADPI Insurance. And guess what, the policies I write for anyone are the same I write for myself. This means I don’t “optimize them” for the agent to make more money (that’s for another post!), I optimize them for the client to have a better policy — which, funny enough, means the agent makes less money! I’m 100% okay with that and so is the rest of the team at ADPI that helps 10’s of thousands of active and reserve duty military members and veterans.

So check this out:

In case the graphic is a bit confusing, let me apologize and attempt to decode some of its salient points.

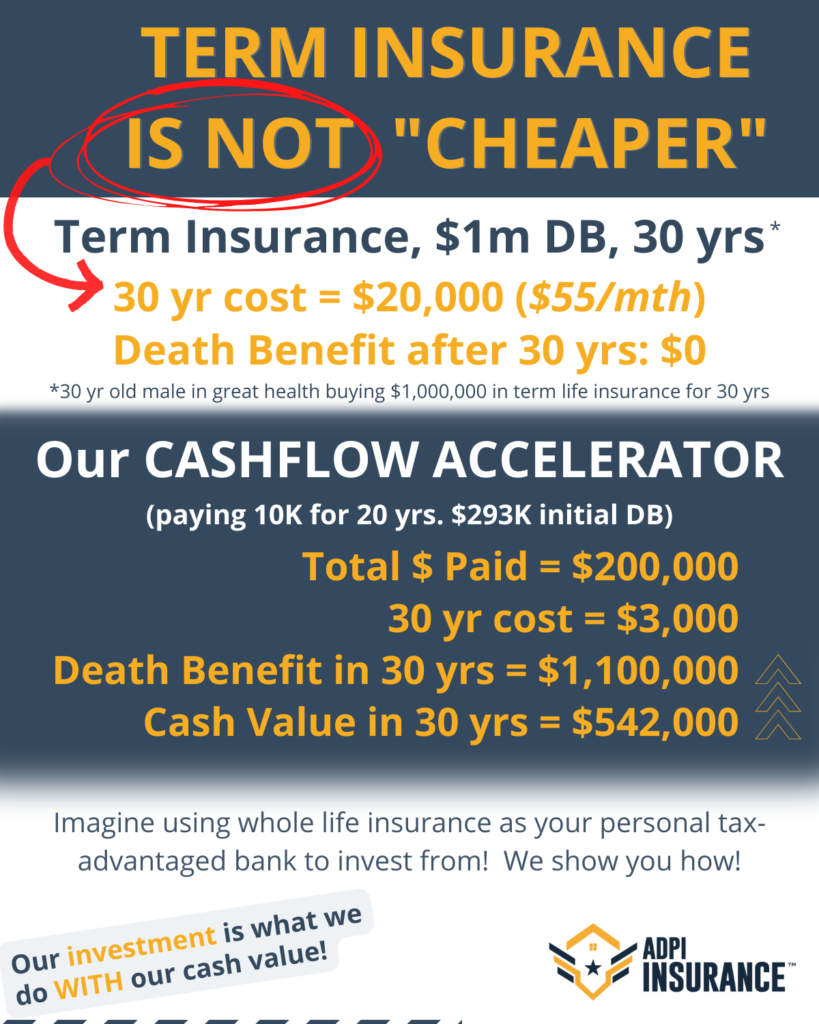

The healthy 30 year old guy who bought a 30 year term life insurance policy with a $1,000,000 death benefit will end up paying around $20,000 over that 30 years ($55 x 360 months = $19,800). Simple enough.

Quick side note: around 97–99% of term policies never have a death claim filed against them? In other words, people rarely die in the grand scheme of term insurance users and therefore this is a massive money maker for insurance companies. You, the client, take all the risk and by the time you’re 60 or so years old the term’s death benefit goes away. Put another way, you’re renting life insurance instead of buying it.

The same guy (in a parallel universe) bought a Cashflow Accelerator that I custom made for him.

He contributes $10,000 a year for 20 yrs. His death benefit in the first year is $293,000. Yikes! “Did you say $10,000?!?!” Yes, $10,000! And by the way, there is no mandatory $10,000. I do this custom made for you. You can put $250,000 a year if you wanted to, or maybe even $500 a month, so long as we build it out before the policy starts. We are all in a different place financially and you can always start more policies in the future. I just used $10,000 for this example.

Remember, this isn’t a “spend and lose it” scheme or a “contribute and it’s locked up until you’re 72” money pitch. On the first year he could access around $8,000 of the $10,000 he contributed (80%), and that’s the “worst year” dollar for dollar he’ll have in the life of his policy. To put it in perspective, around 70% of whole life policies you see will have $0 of cash value the first and sometimes even the second and third year. Imagine putting in $10,000 to $30,000 and having access to $0 of it! << these are what the financial gurus bash (as do I!).

So where do we get the $3,000 cost of this $10,000 a year Cashflow Accelerator? Well, in year one I’m counting the -$2,000, and then I’m counting about -$1,000 in year 2. By year 3 he’s putting in $10,000 and he gets access to that $10,000 give or take a few bucks for that year, plus he still has the total of the previous two years.

This means that from year four onward for every dollar he puts in, year over year, it increases more than that by the end of the same year.

Around the 5th or 6th year is generally when the entire breakeven point comes into play (can vary based on one’s health and age), but the most important number for me is the year I surpass the amount I contributed for that specific year. The insurance costs that we can see are front loaded with these policies and baked into the $10,000. As an investor, I consider this $3,000 cost the same as I consider the down payment on an investment property. It’s a short term expense that I’ll get back many times over in the future.

By the time year 30 hits, here is what happens:

The term life insurance guy no longer has a death benefit (unless he wised up after reading this article and emailed me at [email protected]). Let’s just hope he followed Dave Ramsey and got his 12% a year, every year, in an index fund that doesn’t exist *wink-wink*.

The Cashflow Accelerator guy now has a $1,100,000 death benefit that continues to grow. Remember how his initial death benefit was $293,000? Well, we do that on purpose to optimize the cash value. There is a reason for everything, and that includes building the Cashflow Accelerator to increase his death benefit every year (kind of like the appreciation of a house) — all the way until he dies (hopefully long into the future)!

In our strategy, we may use a term policy to supplement the $293,000 if that was a need of the client. An example would be including a term policy with a $700,000 death benefit with the ability to convert it into a Cashflow Accelerator later with no medical exam needed since it would be based on the approval of the term policy. Pretty cool, right?

With the Cashflow Accelerator he also has a cash value of $542,000 by the end of year 30. He can access this tax free, by the way! And he can access the amount of cash value throughout his life for investments, an emergency fund, loans to himself or family for cars, boats, school, or maybe he has some business investments, real estate, etc. The cash value keeps growing even though the basis of $200,000 stays the same (he doesn’t have to contribute any more than the $200,000). This is the fun part that I’ll write more about later.

So the next time someone tells you that term insurance is cheaper than our Cashflow Accelerator, send him/her this article. Remember, we must compare these life strategies apples-to-apples against the alternatives. A $55/month payment may be “less expensive” on a monthly basis for a period of time, but it would cost this guy millions of dollars over a lifetime. We shouldn’t trip over dollars to pick up pennies.

If you’d like to learn more about using a Cashflow Accelerator for yourself or to get in contact with Derek, you can email him at [email protected].