Going to college is extremely expensive these days.

In general, having children is an expensive 18+ years. It is something my wife and I are about to face with complete joy and overwhelming anxiety. Once senior year rolls around, most parents have to figure out a way to pay a massive college tuition bill, not to mention many other expenses that come along with sending a young adult off into the real world. After all, your college student is going to want to have some spending money in their pocket.

Rather than telling them to find a part-time job, which will most likely hurt their extracurricular activities, study time, and social life, why not invest in their future early on? Help them be smart about money and give them a legacy of financial freedom and literacy.

Here is what you do: In the year that you have a baby, buy him or her a turnkey investment property with a 30-year loan. Have any cash flow go directly towards the principal. If you do this right, it will be paid off before they turn 18. Boom!

How to Pay for Your Child’s College Tuition Through Rental Real Estate Business?

Buying an Investment Property

Check Out the Numbers

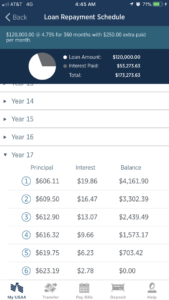

Let’s imagine a hypothetical scenario. You’re a married 27-year-old about to have your first child. You’ve been saving up for this moment and are ready to pull out funds from brokerage accounts and get a quaint 1990’s, fully rehabbed, Midwestern, turn-key investment property for $150,000.

By turn-key, I mean that this is a properly managed, tenanted, and fully renovated investment property in a solid cash flow market. All major maintenance has been completed and it has a warranty on most of the appliances and renovation work.

Kicker: You have not been saving up very much.

Shining Light: You’ve been putting about $5,000 away into your Roth IRA every year since you were twenty years old. You have been reading a lot about taxes and have learned that any capital you put into your ROTH IRA can be withdrawn tax-free and penalty-free. So you take out $30,000 and let the rest grow.

Your down payment is $30,000 and the pro forma predicted that you would be making about $250 a month in cash flow (if you find a good property, this could be significantly higher). Basically, about 10% cash on cash return on investment (ROI).

$250 monthly cash flow x 12 months = $3,000 annual return on investment. $3,000 (annual cash flow return) / 30,000 (investment down payment) = 10% Cash on Cash Return on Investment, or CoC ROI.

Next, you put all that cash flow back into the property. Realistically, your rent will increase at about a 3% annual rate, so your cash flow will actually be about $425 each month by the end of the 18 years (instead of $250). But we will not take this into account, and just say any rent increase will go towards building a reserve account to cover repairs, updates, and unexpected costs.

Boom! Just so happens, that the math works out perfectly…17-18 years later, the property is fully paid off, and you got to claim all the tax benefits and the priceless real estate experience along the way.

Next Steps

Guess what the house is worth now? If we consider an average historical appreciation of real estate is about 5% since the Great Depression, it will give us a good idea of what we can expect.

With a 3% annual appreciation, after 18 years, a $150,000 home will end up being worth about $255,000!

With a 5% annual appreciation, after 18 years, a $150,000 home will be worth a whopping $360,000!

Now you’re thinking, “Ohhh, so now I sell it and use that money to pay for my kid’s college, right?”

Wrong!

Now that the investment property is paid off, the cash flow will be well over $1,000 every month. Why throw away such a powerful asset? If you have to sell it, fine. But explore any options you may have for financing your child’s tuition and then teach them to use the cash flow from the property to pay those tuition bills. Eventually, the debt will be paid off, and guess what? Your son or daughter will still own an investment property and have a very real and tangible understanding of its power. As they go further in their careers, they will see their college friends getting sucked dry by tuition bills and they will thank you. And the good karma probably won’t stop there! This legacy of education will live on and be passed down.

If you really want to teach your son or daughter to step it up a notch while in college, see if it makes sense for them to buy a house of their own and house hack it by leasing it to their friends… could be a killer way to minimize living expenses or maybe even cashflow!

Want to Start Investing in Real Estate? Would you like to get walked through the process with our course and our awesome team?

Check out:

Header photo by Cole Keister on Unspash.

Article was originally written by Markian Sich for Military By Owner:

https://blog.militarybyowner.com/how-rental-real-estate-can-pay-for-your-childs-college-tuition