The VA Loan is full of awesome benefits for veterans and service members. Among others, the no-down payment option is a great opportunity to turn the dream of homeownership into a reality. In the current markets, it seems like interest rates can rise and fall like the tide –so what then? What if you need cash for home improvements? What is involved in refinancing a VA loan?

Two Types of VA Refinance Loans

1. Interest Rate Reduction Refinance Loan (IRRRL or VA Streamline Refinance)

2. VA Cash-Out Refinance

VA IRRRL

The VA IRRRL can benefit you if you currently have a VA mortgage. By using this option, you will refinance to a lower interest rate or you can switch to fixed-rate from an adjustable-rate mortgage. If you’re looking for cash-out from your home equity, this option isn’t for you.

When borrowers use the VA Streamline Refinance to lower their interest rate, this can also reduce monthly mortgage payments. Not only this, but out-of-pocket costs are minimal, and loan closing costs can be combined into the total amount of the loan. One of the other major benefits of this selection is that there is usually no appraisal required for the refinance.

VA Cash-Out Refinance

If borrowers are looking to get cash out for equity in the home, the VA Cash-Out Refinance is the best bet. For this refinance, the current loan can be any type – FHA, USDA, conventional, or VA. With that in mind, veterans and service members still need to qualify for the loan. These loans may have a higher interest rate but may be worth it depending on the use of the cash. Run the numbers and make sure that the refinance makes sense before pulling the trigger.

Applying for a VA Refinance

1. Pick Your Lender

A common misconception is that borrowers are required to use their current lender for a refinance. You can choose whatever lender you prefer. It’s best to shop around to compare interest rates, fees, closing times, etc.

ADPI Financial offers VA loan refinancing in many states, so be sure to shop with them too!

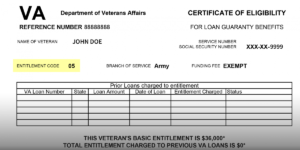

2. Submit your Certificate of Eligibility (COE)

If the original loan is VA-backed, check to see if you still have the Certificate of Eligibility in the loan paperwork. If so, you can submit that to your lender to show your eligibility. If not, don’t fret! Lenders can request it electronically through the VA Portal!

3. Getting to Closing

For a VA cash-out refinance, borrowers will need to submit documentation such as pay stubs, W2s, and federal tax returns. This option is a bit more in-depth than the IRRRL.

You may be wondering about possible fees with refinancing. With the IRRRL, borrowers may be required to pay the funding fee. If you’re concerned about having to pay this up-front, talk with your lender about options that could include rolling it into the loan or raising interest rates so the lender can pay the funding fee.

Depending on the situation, a VA Refinance can be a great opportunity for VA-eligible borrowers. It’s important to take stock of your goals and needs to make sure that you’re making the right decision. If you’d like more information on ADPI’s lending team and how they can help you with refinancing, you can connect with them here: https://www.activedutypassiveincome.com/find-agent-or-lender/. Our lending team can give you guidance and advice on which VA refinance option is right for you!