For eligible veterans and service members, VA loans present a unique opportunity to secure home financing with NO MONEY DOWN! One distinguishing feature of VA loans is the absence of a mandatory down payment. However, understanding the implications and potential benefits of making a down payment is crucial.

As we discuss further we will explore the topic of VA loan down payments, including if down payments are required, why they are not mandatory, the advantages of making a down payment, the drawbacks to consider, and instances when a down payment may be necessary.

Let’s start with what the VA loan is! A VA loan guarantee is a government-backed loan for the military populations, endorsed and protected by the VA. This backing and guarantee allows the lender to seek less stringent qualifications. Once the buyer is approved as a veteran who meets service length requirements, service members on active duty with the minimum service period, certain Reservist and National Guard members, and certain surviving spouses of deceased Veterans can purchase a primary home using a government-backed VA loan.

Do VA Loans Require A Mortgage Down Payment?

VA loans generally do not require a mortgage down payment. This feature sets them apart from many other loan programs, making them an attractive option for eligible veterans and service members. The Department of Veterans Affairs guarantees a portion of the loan, enabling lenders to offer more favorable terms, including the elimination of a mandatory down payment. So what does this mean to you in today’s market? Interestingly enough the answer to this question has shifted over the past 24 months. In the market where interest rates were extremely low many sellers were advised to take the buyers with conventional loans because they could close quicker and had a lower standard for the appraisals! Now that the market has shifted the government backed loans are starting to make a comeback and their overall buying power is back with lenders now being more favorable toward them allowing current buyers to keep their cash in their pockets and fear less about their position in the market being rejected!

Why VA Loans Don’t Require A Down Payment

VA loans do not require a down payment primarily due to the government backing provided by The Department of Veterans Affairs. This guarantee mitigates the risk for lenders, allowing them to provide financing without the need for a down payment. As a result, eligible borrowers can access homeownership without the immediate burden of saving for a significant down payment. This is why it is important as a VA buyer using the VA loan for the first time or for secondary use you understand your allowed amount! You can learn more about your Certificate of Eligibility (COE) in our previous blogs!

Should You Make a VA Down Payment Even Though It’s Not Required?

While VA loans do not mandate a down payment in most qualified buyer’s cases, borrowers have the option to make one if they choose. Deciding whether to make a down payment depends on individual circumstances and financial goals. It is important to evaluate factors such as personal finances, long-term financial objectives, and the potential benefits and drawbacks associated with making a down payment.

Lowers The VA Funding Fee

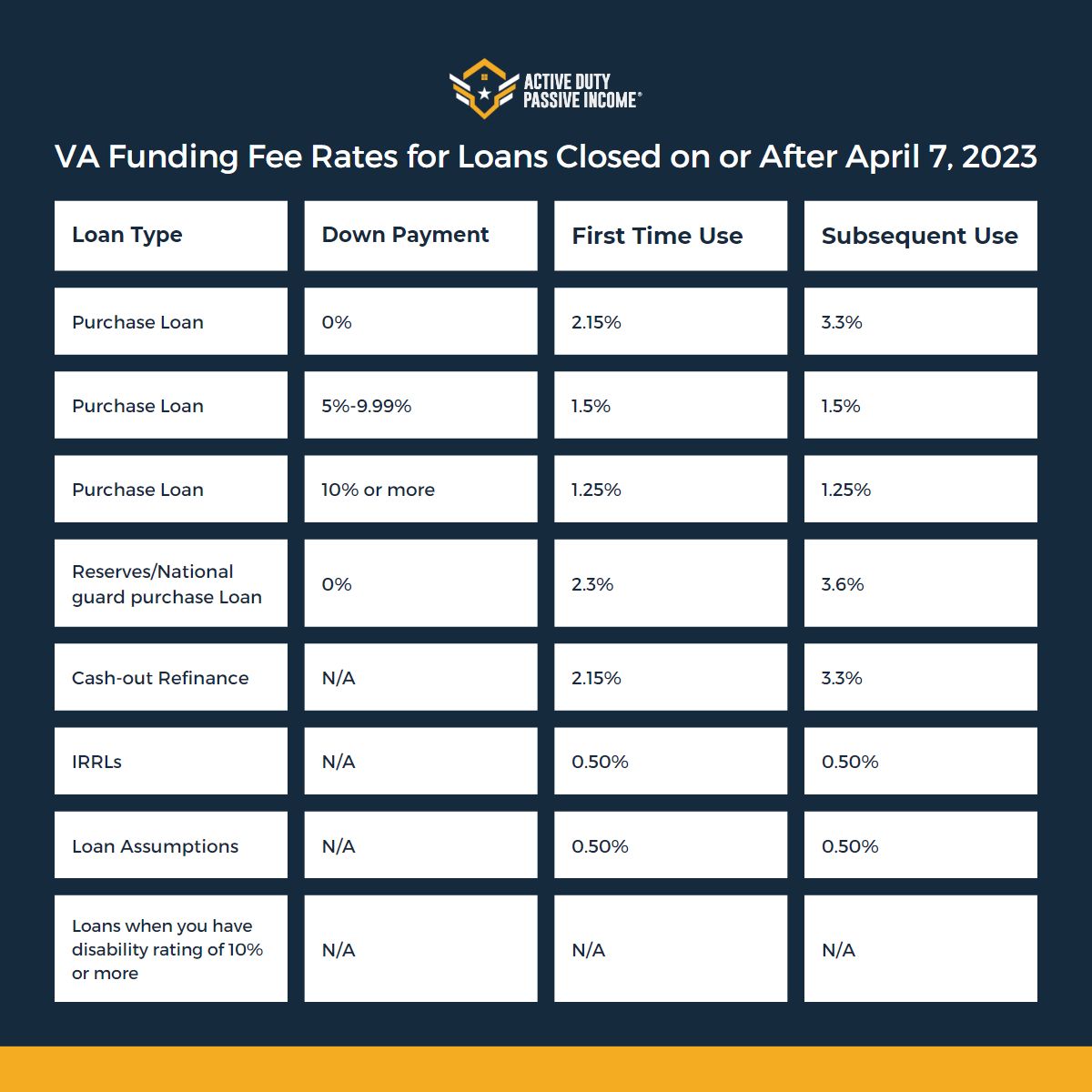

Making a down payment on a VA loan can lower the VA funding fee, which is a one-time fee paid to the Department of Veterans Affairs. The funding fee varies based on factors such as the down payment amount and military service category. By reducing the loan amount through a down payment, borrowers can potentially lower the funding fee on secondary uses of their VA loan benefits.

Save on Loan Monthly Payments

Making a down payment on a VA loan or any loan can lead to lower monthly mortgage payments. A reduced loan amount results in a smaller principal balance, potentially decreasing the overall loan payment and providing financial relief on a monthly basis.

| Loan Amount | Interest Rate | Monthly Payment | Total Interest Paid | |

| $200,000 | 5% | $1074.65 | $134,874.17 | $334,874.17 |

| $175,000 | 5% | $940.98 | $118,186.04 | $293,186.04 |

In this table, the “Loan Amount” column represents the principal amount borrowed, the “Interest Rate” column indicates the annual interest rate applied to the loan, the “Monthly Payment” column shows the amount to be paid each month (assuming a 30-year fixed-rate loan), the “Total Interest Paid” column displays the cumulative interest paid over the loan term, and the “Total Repaid” column represents the total amount repaid, including both the principal and interest.

As we can see, the main differences between the two loans are the loan amount, monthly payment, total interest paid, and the total amount repaid. The $200,000 loan has a higher monthly payment, higher total interest paid, and a higher total amount repaid compared to the $175,000 loan. This is because the higher loan amount results in a larger principal balance on which interest is charged.

It’s important to note that the table assumes a fixed interest rate for the entire loan term and does not take into account factors such as additional fees, prepayment options, or changes in interest rates over time. These factors can influence the actual terms and total cost of a loan.

Build Equity Quicker

A down payment on a VA loan allows borrowers to start with home equity immediately. By investing personal funds into the property, borrowers gain ownership stake, build equity from the outset, and potentially benefit from increased home value over time.

It’s important to monitor your home equity as a homeowner. Regularly assessing the value of your property and keeping track of your outstanding mortgage balance will help you understand the equity you have and make informed decisions regarding your finances and homeownership goals.

It’s worth noting that equity is influenced by various factors, including the housing market, property maintenance, and the overall economic conditions. Therefore, it’s advisable to consult with real estate professionals and financial advisors to gain a deeper understanding of how equity works and how it can be leveraged effectively to meet your individual financial objectives.

Equity can build up in several ways:

- Mortgage Payments: Each mortgage payment you make helps to reduce the principal amount owed, thereby increasing your equity. In the early years of your mortgage, a larger portion of your payment goes towards interest, but as you progress, a greater portion is applied towards the principal, accelerating the growth of your equity.

- Home Value Appreciation: Over time, the market value of your home may increase. If the value of your property goes up, it adds to your equity without you having to make additional payments. However, it’s important to note that home values can also decrease, leading to a decrease in equity.

- Home Improvements: Making improvements or renovations to your home can also increase its market value, thereby boosting your equity. By enhancing the condition or features of your property, you can potentially increase its worth beyond the original purchase price.

Become More Competitive in the Market

In highly competitive real estate markets, making a down payment can strengthen the offer and make it more appealing to sellers. A down payment demonstrates financial stability and commitment, potentially giving buyers an edge in multiple-offer situations.

Increases VA Approval Chance

In some cases, a down payment can improve the chances of VA loan approval. Although VA loans typically have lenient approval requirements, making a down payment can reduce the lender’s risk and increase the likelihood of loan approval, especially for borrowers with marginal credit or unique circumstances. Consulting a lender and letting them know upfront you want to seek an opportunity to utilize your VA loan benefits will help them evaluate your credit worthiness to obtain a loan!

Drawbacks of Making a Down Payment on a VA Loan

Long Term financial impact of not putting a down payment on your purchase, may leave you with a higher debt burden and less available cash for other financial goals or emergencies. It’s important to consider the impact of your home purchase on your overall financial picture and weigh the opportunity costs of tying up funds in your home versus other potential investments or financial priorities.

You Might Have to Wait for Your VA Loan

If a borrower chooses to make a down payment on a VA loan, it is important to consider that the funds must be sourced and verified before closing. This process might introduce additional time, potentially delaying the loan closing. Typically this can be taken care of by talking with the title company and ensuring you understand the full obligation to have the money at the closing table the day of closing!

You Could Drain Your Savings

Making a down payment on a VA loan could require a significant amount of money upfront. While it can lead to long term benefits, such as lower monthly payments and increased equity, it is essential to consider the impact on your savings. Draining your savings to make a down payment may leave you financially vulnerable in the event of unexpected expenses or emergencies. It is important to strike a balance between down payment affordability and maintaining a sufficient emergency fund.

You Might Need the Money to Fix Up Your New Place

When purchasing a home, it’s common to have expenses related to repairs, renovations, or personalizing the property to your preferences. By using a portion of your savings for a down payment, you may have limited funds available for necessary or desired home improvements. It’s essential to consider the potential costs involved in fixing up your new place and ensure you have sufficient funds for both the down payment and any necessary updates.

When a Down Payment Is Required on a VA Loan

In most cases, a down payment is not required on a VA loan. However, there are instances where a down payment may be necessary. If the purchase price of the home exceeds the VA loan limit for your area, you may need to make a down payment to cover the difference. Additionally, if you have used your VA loan eligibility in the past and have not restored it, a down payment may be required to secure the loan. It is crucial to consult with your lender to determine specific requirements based on your circumstances.

While VA loans typically do not require a down payment, it is essential to weigh the potential drawbacks of draining your savings and consider the expenses associated with home improvements. Understanding when a down payment is required and when it is not is vital but not the end all, be all. Understanding your overall financial situation is important to make the decision in the cases where you qualify for no money down! Happy house hunting!

ADPI ProTips

ADPI (Active Duty Passive Income) ProTips offer valuable insights for navigating VA loans and making informed decisions about down payments. Here are a few ProTips to consider:

- Evaluate your financial situation: Assess your savings, monthly budget, and long-term financial goals to determine the feasibility and potential benefits of making a down payment.

- Consult with a VA loan lender specialist: Work with a knowledgeable VA loan specialist who can guide you through the process, explain your options, and provide personalized advice based on your situation.

- Consider your future plans: Think about your future goals, such as potential relocations or career changes, and how they may impact your homeownership journey. This can help inform your decision on making a down payment.